All you need to know about Labour Welfare Fund

Labour welfare can be seen as any assistance in terms of money or kind for the working class. These facilities help the labourers in improving their working conditions, assisting their social security, and raising their standard of living. The Labour Welfare Fund Act encapsulates a variety of services, benefits and other facilities which an employer offers to the employee. These facilities are offered in the form of contributions from the employer and the employee.

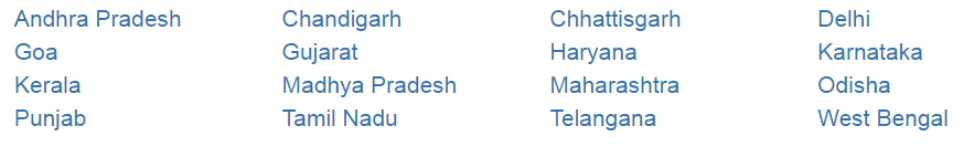

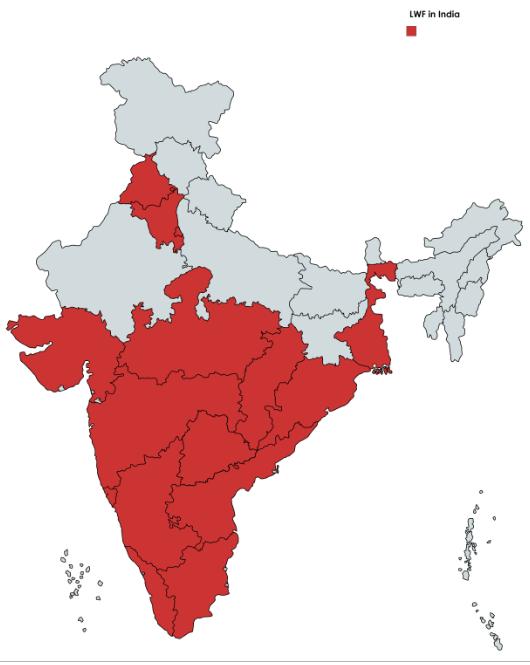

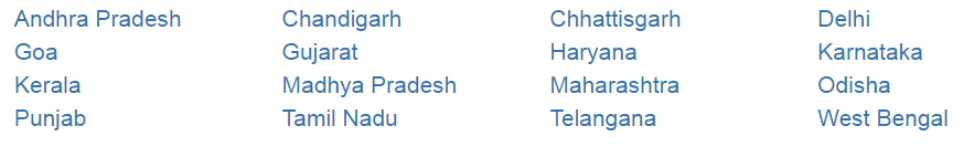

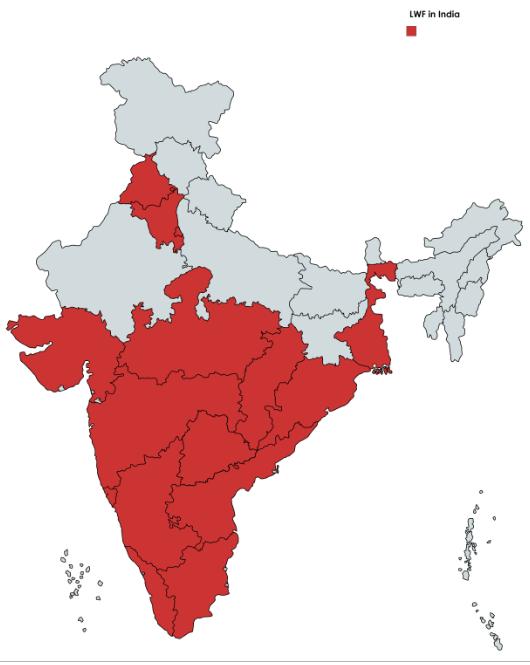

Applicability of Labour Welfare Fund Act (State-Wise):

The Government of India launched the Labour Welfare Act to implement some social security for workers. The Labour Welfare Act is currently active in only 15 States and 1 Union Territory, in the country.

1. Andhra Pradesh

| Act | Andhra Pradesh Labour Welfare Fund Act, 1987 |

| Rule | The Andhra Pradesh Labour Welfare Fund Rules, 1988 |

| Applicability | Any Employer/Establishment employing one or more employees/persons |

| Frequency | Yearly |

| Form | FORM F.xlsx |

| Website | http://labour.ap.gov.in/ELabour/Views/RecentAmendementNewActs.aspx |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date ForSubmission |

| All employees except those employed mainly in a managerial capacity or who are employed as an apprentice or on a part-time basis | 30.00 | 70.00 | 100.00 | 31st December | 31st January |

2. Chandigarh

| Act | The Punjab Labour Welfare Fund Act,1965 |

| Rule | The Punjab Labour Welfare Fund Rules,1966 |

| Applicability | Any Employer/Establishment employing one or more employees/persons |

| Frequency | Monthly |

| Form |

| Website | http://chandigarh.gov.in/dept_labour.htm |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| Employees drawing salaries upto Rupees Fifteen Thousand per month | 5.00 | 20.00 | 25.00 | Last Day Of the Month | 15th October15th April |

3. Chhattisgarh

| Act | The Chhattisgarh Shram Kalyan Nidhi Adhiniyam, 1982 |

| Rule | The Chhattisgarh Pradesh Shram Kalyan Nidhi Rules, 1984 |

| Applicability | Any Employer/Establishment employing one or more employees/persons |

| Frequency | Half Yearly |

| Form | FORM A.docx Chhattisgarh-shram-kalyan-nidhi-adhiniyam-applicability.pdf |

| Website | http://cglabour.nic.in/ShramKalyanMandal/abhidayrashi.aspx |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees except those working in a managerial or administrative capacity or employed in a supervisory capacity drawing wages exceeding ten thousand per month | 15.00 | 45.00 | 60.00 | 30th June | 15th July |

| All employees except those working in a managerial or administrative capacity or employed in a supervisory capacity drawing wages exceeding ten thousand per month | 15.00 | 45.00 | 60.00 | 31st December | 15th January |

Confused about EPF calculation? Learn about EPF calculation using 5 easy steps.

4. Delhi

| Act | The Bombay Labour Welfare Fund Act, 1953 |

| Rule | The Delhi Labour Welfare Fund Rules, 1997 |

| Applicability | Any Employer/Establishment employing five or more employees/persons |

| Frequency | Half Yearly |

| Form | FORM A.docx |

| Website | http://www.delhi.gov.in/wps/wcm/connect/DOIT_Labour/labour/notification/labour+welfare+funds |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding Rupees Two thousand Five Hundred only per month | 0.75 | 2.25 | 3.00 | 30th June | 15th July |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding Rupees Two thousand Five Hundred only per month | 0.75 | 2.25 | 3.00 | 31st December | 15th January |

5. Goa

| Act | The Goa Labour Welfare Fund Act, 1986 |

| Rule | Goa Labour Welfare Fund, Rules 1990 |

| Applicability | Any Employer/Establishment employing one or more employees/persons |

| Frequency | Any Employer/Establishment employing one or more employees/persons |

| Form | FORM A.xlsx |

| Website | http://labour.goa.gov.in/index.php/goa-lwb/ |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees except those working in a managerial or supervisory capacity and drawing wages exceeding rupees one thousand six hundred only per month | 60.00 | 180.00 | 240.00 | 30th June | 31st July |

| All employees except those working in a managerial or supervisory capacity and drawing wages exceeding rupees one thousand six hundred only per month | 60.00 | 180.00 | 240.00 | 31st December | 31st January |

6. Gujarat

| Act | The Gujarat Labour Welfare Fund Act, 1953 |

| Rule | The Labour Welfare Fund (Gujarat) Rules, 1962 |

| Applicability | Any Employer/Establishment employing ten or more employees/persons |

| Frequency | Half Yearly |

| Form | FORM A-1.docx |

| Website | https://glwb.gujarat.gov.in/ |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date O fDeduction | Last Date for submission |

| All employees except those working in a managerial or supervisory capacity and drawing wages exceeding rupees three thousand and five hundred per month | 6.00 | 12.00 | 18.00 | 30th June | 15th July |

| All employees except those working in a managerial or supervisory capacity and drawing wages exceeding rupees three thousand and five hundred per month | 6.00 | 12.00 | 18.00 | 31st December | 15th January |

7. Haryana

| Act | The Punjab Labour Welfare Fund Act,1965 |

| Rule | The Punjab Labour Welfare Fund Rules,1966 |

| Applicability | Any Employer/Establishment employing ten or more employees/persons |

| Frequency | Monthly |

| Form |

| Website | https://hrylabour.gov.in/content/cms/MTU |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees employed, directly by or through any agency (including a contractor) with or without the knowledge of the principal employer, for remuneration in any factory or establishment to do any work connected with its affairs. Each employee shall contribute to the Fund every month an amount equal to zero point two percent of his salary or wages or any remuneration subject to a limit of rupees twenty-five and each employer in respect of each such employee shall contribute to the Fund every month, twice the amount contributed by such employee | 25.00 | 50.00 | 75.00 | Every Month (Also being accepted QuarterlyHalf YearlyYearly in some instances) | Last Day Of The Month (Also being accepted QuarterlyHalf YearlyYearly in some instances) |

8. Karnataka

| Act | The Karnataka Labour Welfare Fund Act, 1965 |

| Rule | The Karnataka Labour Welfare Fund Rules, 1968 |

| Applicability | Any Employer/Establishment employing fifty or more employees/persons |

| Frequency | Yearly |

| Form | FORM D.docx |

| Website | http://labour.kar.nic.in/labour/klwboard.htm |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees who are employed for wages to do any work skilled or unskilled, manual or clerical, in an establishment | 20.00 | 40.00 | 60.00 | 31st December | 15th January |

9. Kerala

| Act | The Kerala Shops And Commercial Establishments Workers Welfare Fund Act,2006 |

| Rule | The Kerala Shops And Commercial Establishments Workers Welfare Fund Scheme, 2007 |

| Applicability | Any Employer/Establishment employing one or more employees/persons |

| Frequency | Monthly |

| Form | FORM 6.docx Form – 5.xlsx |

| Website | http://peedika.kerala.gov.in/ |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees under the purview of the Kerala Shops and Commercial Establishments Act, 1960 | 50.00 | 50.00 | 100.00 | Monthly | 5th Of Every Month |

10. Madhya Pradesh

| Act | The Madhya Pradesh Shram Kalyan Nidhi Adhiniyam, 1982 |

| Rule | The Madhya Pradesh Shram Kalyan Nidhi Rules, 1984 |

| Applicability | The Madhya Pradesh Shram Kalyan Nidhi Rules, 1984 |

| Frequency | Half Yearly |

| Form | FORM A.docx madhya-pradesh-shram-kalyan-nidhi-adhiniyam-applicability.pdf |

| Website | http://shramsewa.mp.gov.in/labourwelfareboard/en-us/ |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date ForSubmission |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding Rupees Ten Thousand only per month | 10.00 | 30.00 | 40.00 | 30th June | 15th July |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding Rupees Ten Thousand only per month | 10.00 | 30.00 | 40.00 | 31st December | 15th January |

11. Maharashtra

| Act | The Maharashtra Labour Welfare Fund Act, 1953 |

| Rule | The Maharashtra Labour Welfare Fund Rules, 1953 |

| Applicability | Any Employer/Establishment employing five or more employees/persons |

| Frequency | Half Yearly |

| Form | FORM A-1.xls |

| Website | https://mahakamgar.maharashtra.gov.in/index.htm |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees except those working in the managerial or supervisory capacity and drawing wages upto Rupees Three Thousand only per month | 6.00 | 18.00 | 24.00 | 30th June | 15th July |

| All employees except those working in the managerial or supervisory capacity and drawing wages upto Rupees Three Thousand only per month | 6.00 | 18.00 | 24.00 | 31st December | 15th January |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding Rupees Three Thousand only per month | 12.00 | 36.00 | 48.00 | 30th June | 15th July |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding Rupees Three Thousand only per month | 12.00 | 36.00 | 48.00 | 31st December | 15th January |

12. Odisha

| Act | The Odisha Labour Welfare Fund Act, 1996 |

| Rule | The Odisha Labour Welfare Fund Rules, 2015 |

| Applicability | Any Employer/Establishment employing twenty or more employees/persons |

| Frequency | Half Yearly |

| Form | FORM F.docx |

| Website | http://www.labdirodisha.gov.in/ |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees except those working in the managerial or supervisory capacity and who is employed as an apprentice or on a part-time basis | 10.00 | 20.00 | 30.00 | 30th June | 15th July |

| All employees except those working in the managerial or supervisory capacity and who is employed as an apprentice or on a part-time basis | 10.00 | 20.00 | 30.00 | 31st December | 15th January |

13. Punjab

| Act | The Punjab Labour Welfare Fund Act,1965 |

| Rule | The Punjab Labour Welfare Fund Rules 1966 |

| Applicability | Any Employer/Establishment employing twenty or more employees/persons |

| Frequency | Monthly |

| Form |

| Website | http://pblabour.gov.in/ |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| Any person who is employed for hire or reward to do any work, skilled or unskilled, manual or clerical, in an establishment | 5.00 | 20.00 | 25.00 | Last Day Of the Month | 15th April15th October |

14. Tamil Nadu

| Act | The Tamil Nadu Labour Welfare Fund Act, 1972 |

| Rule | The Tamil Nadu Labour Welfare Fund Rules, 1973 |

| Applicability | Any Employer/Establishment employing five or more employees/persons |

| Frequency | Yearly |

| Form | FORM A.docx |

| Website | https://www.lwb.tn.gov.in/ |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees except those working in a managerial or supervisory capacity and drawing wages exceeding rupees Fifteen thousand per month or who are employed as an apprentice or on a part-time basis | 20.00 | 40.00 | 60.00 | 31st December | 31st January |

15. Telangana

| Act | Telangana Labour Welfare Fund Act, 1987 |

| Rule | Telangana Labour Welfare Fund Rules, 1988 |

| Applicability | Any Employer/Establishment employing twenty or more employees/persons |

| Frequency | Yearly |

| Form | FORM F.xlsx |

| Website | https://labour.telangana.gov.in/AboutUs.do |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All Employees except those working in the managerial or supervisory capacity and drawing wages exceeding rupees one thousand six hundred per month | 2.00 | 5.00 | 7.00 | 31st December | 31st January |

16. West Bengal

| Act | The West Bengal Labour Welfare Fund Act, 1974 |

| Rule | The West Bengal Labour Welfare Fund Rules, 1976 |

| Applicability | Any Employer/Establishment employing ten or more employees/persons |

| Frequency | Half Yearly |

| Form | FORM D Statement Regarding Contributions.docx |

| Website | http://www.wblwb.org/html/index.php |

Labour Welfare Fund Contribution

| Category | Employee Contribution | Employer Contribution | Total Contribution | Date Of Deduction | Last Date for submission |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding rupees thousand six hundred per month | 3.00 | 15.00 | 18.00 | 30th June | 15th July |

| All employees except those working in the managerial or supervisory capacity and drawing wages exceeding rupees thousand six hundred per month | 3.00 | 15.00 | 18.00 | 31st December | 15th January |

Eligible Establishments and Employees

The Labour Welfare Fund Act does not apply to each and every employee working in an establishment. The applicability of the Act depends on the employee’s salary as well as his designation. The employer too needs to pay attention to the number of employees working at his company to avail of the Act. Furthermore, it depends on the State the establishment is in, to check the applicability of the Act depending on the number of employees.

For example, in Maharashtra, the Labour Welfare Act applies to all establishments employing 5 or more employees except supervisors and managers who draw wages above Rs 3000. Whereas in Punjab establishments employing 20 or more workers are covered under the Act and have no restriction on the number of wages or designation of employees.

Period of Remittance

The State Labour Welfare Board decides the amount of contribution and the frequency of the contribution. The contribution to the Labour Welfare Fund may occur annually, half-yearly or monthly. Some states such as Karnataka, Haryana, Tamil Nadu, Andhra Pradesh, have an annual contribution. While some states such as Maharashtra, Gujarat, Madhya Pradesh have contributions during June and December months.

Calculate Labour Welfare Fund for Different States and See Employer’s and Employee’s Contribution

Labour Welfare Fund Benefits for Employees

In general, the money in the Labour Welfare Fund may be utilized by the Board to defray expenditures on the following:

- For the education of the children of the workers.

- Provide medical facilities for employers in the public and private sectors. so that they, in turn, can contribute those facilities to their employees and families.

- Transportation facilities for the workers for commuting to work.

- Entertainment and recreational activities like sports, music, etc. for the employees to create a healthy work environment, which also includes travel stipends for participating in sports competitions.

- Under the housing amenities, loans are offered to industrial workers for the construction of houses at discounted rates.

- Provision for excursions, tours and holiday homes.

- Subsidiary occupations and home industries for women and unemployed persons.

- Reading rooms and libraries.

- Vocational training.

- Nutritious food to the children of employees.

- Scholarship for children of workers.

Please don’t forget to check out our in-depth video on this topic below:

If you found this blog useful, you can also see our courses on Labour Welfare Fund and Professional Tax. Speaking of Labour Welfare, another interesting topic to check out is the ESI Act.

23723 Blog Views

- Tags

- labor welfare fund

- labour welfare fund

- lwf